Have you ever heard of scalping? It’s a controversial trading strategy where traders make minimal, quick trades on brief price changes in the markets. Scalping is a popular investment technique for day traders who want to capitalize on short-term stock market momentum; however, it can be tricky and comes with some risks.

In this article, we’ll explore the potential rewards and pitfalls of scalping. How it works, how to determine if it’s right for your investing style, and what strategies are best suited to succeed as a scalper, so you can decide if taking advantage of scalping is something worth trying out.

What is scalping, and how does it work

Scalping can be an exciting but risky endeavour involving purchasing and reselling large tickets for events such as concerts or sporting games. The ticket scalper’s primary objective is to buy tickets for less than their face value and then resell them at a higher price, thus taking advantage of the price difference. It takes diligent checking of websites and ticket brokers to find unbeatable deals.

Once a good deal is found, scalpers must act fast before another buyer gets the ticket at a lower price. Scalping isn’t always successful, though, as there are risks associated with even purchasing tickets – they could already be sold out or too expensive by the time your purchase order goes through. Despite its unpredictable nature, scalping remains attractive for some due to its potential for finding good opportunities and high-paced situations.

The benefits of scalping

The most apparent benefit of scalping is the potential for taking advantage of quick trades. By buying a stock or security and reselling it shortly after, scalpers can make money in minutes instead of waiting weeks or months to see their gains. Scalping also involves less risk than long-term investing since positions are typically held for brief periods, and there is no need to buy and hold stocks for extended periods.

Another advantage of scalping is that it requires minimal capital; traders don’t need a large account balance to get started, and they don’t have to worry about leverage as much as investors using more traditional strategies do.

Finally, trading costs are also kept low because trades can be executed quickly with just one click of a mouse button. For those looking to try scalping themselves, Saxo Bank Dubai provide competitive commissions on scalping trades.

How to scalp stocks

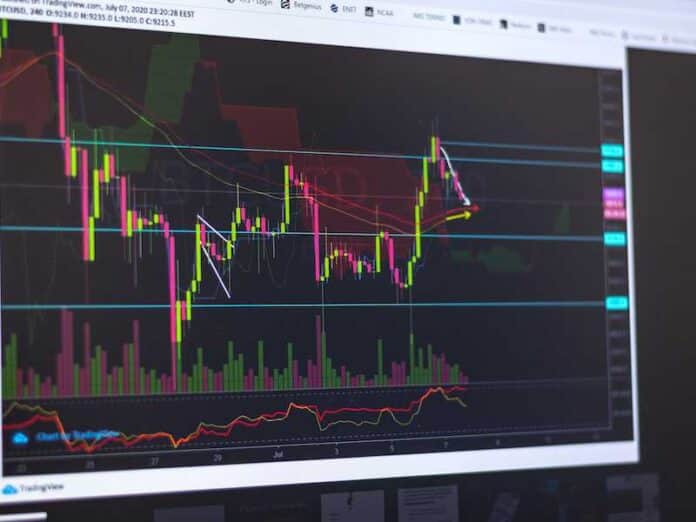

If you’re interested in scalping stocks, the most important thing you need to do is research and understand which stocks are best for scalping. Scalpers should look for volatile stocks that move up and down quickly, allowing them to buy low and sell high regularly, taking advantage of short-term price changes.

When trading with scalping strategies, it’s also important to use risk management techniques such as placing stop losses or trailing stops. The goal of scalping is to make several advantageous trades throughout the day, but traders want to avoid being caught off guard if the market suddenly turns against them. Placing stop losses helps minimize risk and protects your trades.

In addition to understanding which stocks to trade, scalpers need to develop a strategy for when to enter and exit the market. It could entail looking for trading signals from technical analysis or monitoring price action. By understanding how price trends are forming and how they’re likely to progress, traders can make more informed decisions about when to buy and sell.

Tips for becoming a successful scalper

Scalping is not for the faint of heart or for those with a weak stomach. It’s essential to be disciplined and maintain an organized trading plan. Scalpers should also have a strict risk management strategy before entering any trades.

It’s also essential to stay up to date on news and developments that could affect stock prices. Understanding the fundamentals behind a stock can help scalpers decide when to buy and sell.

Finally, scalpers should be prepared for extended trading hours and understand their trading markets. Scalping can be advantageous, but it takes dedication and hard work. With these tips in mind, scalpers can make successful trades.

The risks of scalping

Despite its potential rewards, scalping also carries some significant risks. The most considerable risk is capital loss due to bad timing and execution errors; scalpers can quickly find themselves in the red when a trade goes wrong.

In addition, scalping can be a very stressful endeavour; the fast-paced nature of the markets and frequent trades can lead to fatigue and trading mistakes. Finally, because positions are held for such short periods, scalpers may need help to take advantage of long-term trends that could lead to more significant returns.

Conclusion

Scalping can be a great way to make money in the stock market, but traders must understand the risks and rewards associated with this highly active trading style. Scalpers should have a clear understanding of how and when to enter and exit trades and a comprehensive risk management strategy. With discipline and dedication, it’s possible to make a living scalping the markets.